You could pay more tax than you need to if you continue to pay yourself from your limited company with a low salary and take the rest of your earnings as dividends.

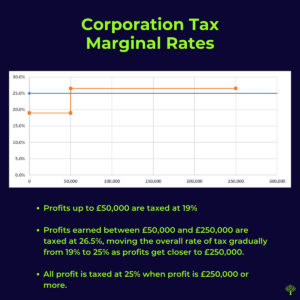

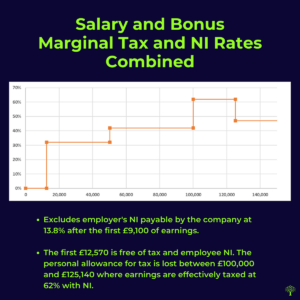

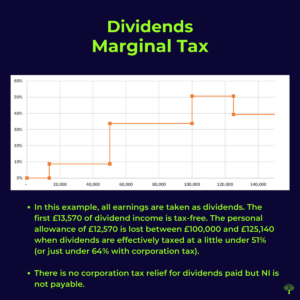

That’s because corporation tax on profits is moving from one single corporation tax rate to effectively three rates from April, as high as 26.5%. As dividends do not offer any corporation tax relief, higher or additional rate taxpayers might be better off by taking more pay by salary which does reduce taxable profits. Despite the potential tax advantage of paying more in salary, it may not suit those used to receiving their dividend earnings in full and paying tax instalments each January and July.

The general advice is that the company pays more into the director’s pension. This offers corporation tax relief and the potential for tax-free income later in life. The trouble with this advice is that it won’t be practical for all. Access to these pension funds could be some time off and for many, income is needed now to live and maintain a lifestyle.

As the tax-free personal allowance begins to reduce when earnings exceed £100,000 until it is lost completely at £125,140, tax is effectively over 60% on this proportion of income when paid through PAYE (with NI) or by dividends (after corporation tax). At over £100,000, parents lose tax-free childcare and those with pre-school children will see 30 hours a week funding drop to 15 hours. With the additional rate of tax starting at £125,140, it might be worth avoiding earning over £100,000.

The regular preparation of management accounts and forecasting allows agency owners to have clarity over their financials and support their decision-making. Having a reliable estimated profit for 2023/24 tax planning adds to the incentive of having management accounts and forecasting prepared.

At Barnridge, we specialise in agencies, including tax planning for limited companies and their owners. Please get in touch if you would like to learn more.